Is the 'S-Curve' moment for Neurotechnology here?

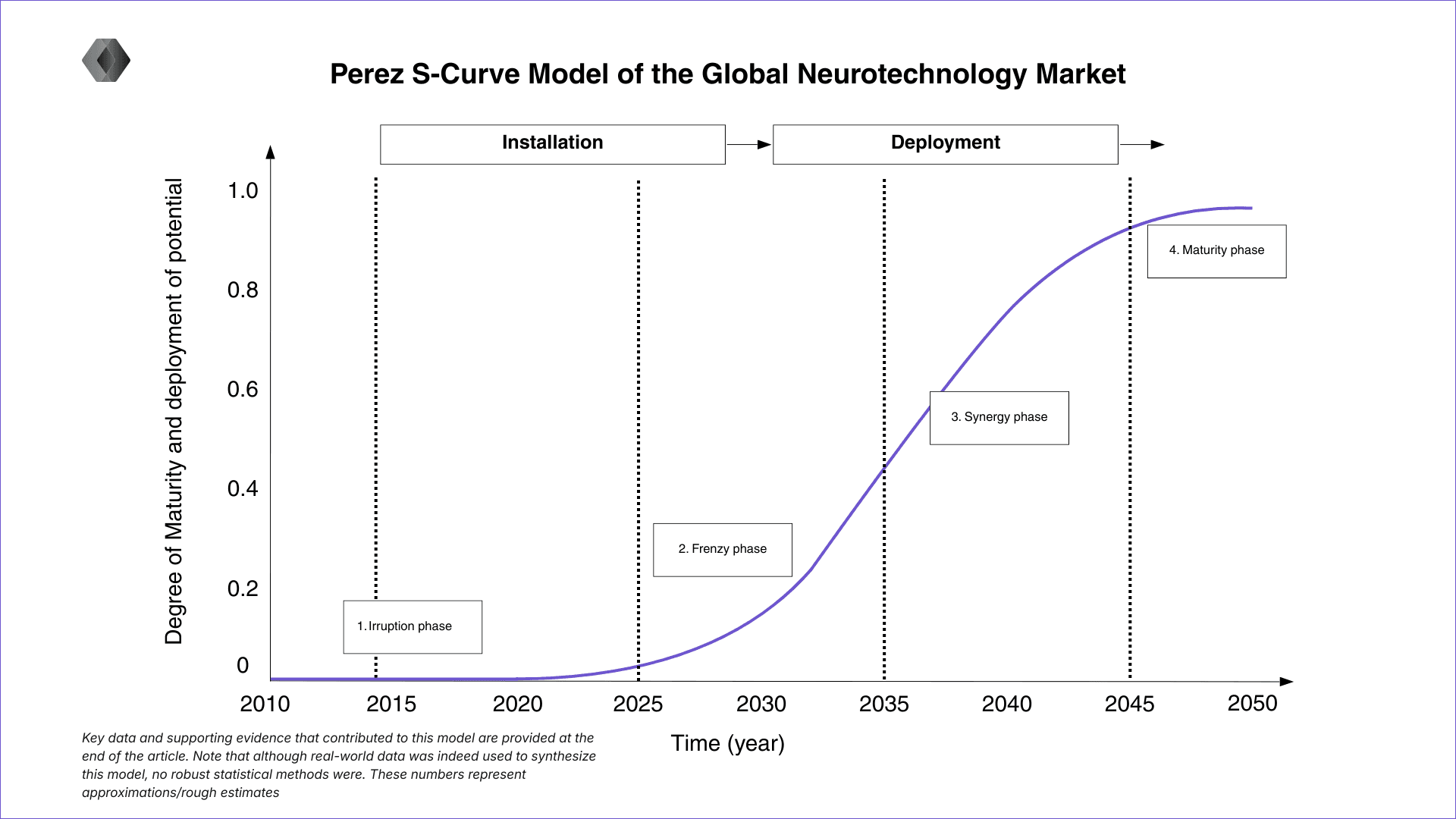

Every major technological revolution can be characterized by the precise adoption curve it follows. Carlota Perez describes this as a technological surge cycle: a new paradigm appears, bubbles and crashes its way into the world, and then quietly becomes the background infrastructure of everyday life.

From railways, electricity, and even the internet, each has traced some sort of S-shaped curve of diffusion.

Broadly speaking, this curve has two big eras. First comes Installation, when a new technology erupts out of labs and garages (Irruption), then overheats as speculative capital races ahead of real use (the 'Frenzy' phase).

After a correction, we enter the 'Deployment' phase. This is the stage when the tech is woven into society on a sectoral basis, followed by Maturity, where growth slows and the system is largely built out. Financial capital leads in Installation, whereas production capital and real users lead in Deployment.

The question for us is simple: where is neuroscience technology (aka neurotech) on that curve, and what kind of platform will ride the steep middle?

Gauging the timeline

On the numbers, neurotechnology (spanning BCIs, neuromodulation systems, EEG and neurophysiology devices) is still small relative to both its projections and the rest of health tech.

One set of estimates puts the global neurotechnology market at about $13.4B in 2023, up from $11.9B in 2022, growing close to 13% per year. [1]

Another analysis pegs it at $14.37B in 2023, with a forecast of $39.95B by 2032, roughly 12% CAGR. [2]

Hardware-focused reports converge on the same order of magnitude: with neurotech devices having reached $12.1B in 2022, heading toward $42.1B by 2032. [3]

To put it simply, independent analysts all cluster around $13–15B of annual spend today, with trajectories pointing to $35–40B+ by the early 2030s. For a technology that hasn't received much media attention until ~ 5 years ago, we consider these estimates representative of extraordinary progress.

Compare that to the rest of medicine and you see how early we still are. The global medical devices market was about $740B in 2023, and is expected to pass $1.3T by 2029. [7]

Digital health alone is already in the high hundreds of billions, on track for close to $1T by 2030. [8]

Even if you take the higher neurotech estimates, we’re talking about ~2% of the medical-device universe and roughly 5% of digital health. This is a thin sliver of spend in a world where neurological and psychiatric disease account for an outsized share of global disability.

For the S-curve model pictured above, we treat today’s ~$14B neurotech spend as the lower-left segment of Perez’s surge cycle.

At the tail end of Irruption (where the paradigm starts to become visible), the growth rates are real, but the technology has not yet crossed into the speculative Frenzy phase or the mainstream Synergy that follows.

The point isn’t that we can pin down the final plateau relative to the scale of medicine and digital infrastructure.

Whether neurotech tops out at $100B, $200B, or more, we are still in the single-digit percentage range of what a mature neurotech stack could represent.

What makes these statistics exceptionally important to us is that we are now in the window in which platform choices are made.

The platform for neurotech’s cambrian moment

Elata’s response to this moment is straightforward: we are building the platform layer for the coming explosion in brain-connected digital experiences.

At the core is an economic engine that ties together remote imaging modalities, specialized at-home devices, apps, and users.

Our vision is to create a world where anyone can plug in a compatible device, connect to an application, and participate in a broad array of incentives that bolster practical everyday experiences, adoption, and most of all an apparatus that drives improvement across the entire market.

Ecosystem funds, standardized developer toolkits, capital formation, revenue-sharing, and upside participation are inherent to the platform, making devices both more affordable and accessible while simultaneously ensuring everyday users share in the upside of the S-curve they’re helping create.

Best of all is that we’re building a device-agnostic neuro stack with the following core components:

A hardware abstraction layer that can speak to any compliant consumer device, from EEG/MEG/fNRIS headbands, earbuds with neuro-sensing, and even to more general purpose devices such as AR/VR headsets and your webcam (yes, you read that correctly). That way, developers don’t have to excessively concern themselves with the means to which users engage with their apps

An ecosystem-native signal-processing engine that handles filtering, artifact removal, and feature extraction, turning noisy bio signals into clean representations

A decoding engine that translates those representations into mental-state estimates, commands, and metrics that apps can actually use

ML neuro-profiles powered by federated learning. Models live at the edge on user devices, learn from each person’s data locally, and contribute encrypted updates to shared models. Raw brain data stays where it should: on the user’s device, away from third-party exploitation. Meanwhile, the network as a whole gets smarter and more accurate. Elata uses an edge + cloud FL framework so personalization and privacy are built in, not bolted on

An app and model layer. APIs and SDKs that let developers ship new neuro-powered experiences in days, not years or months. We believe that in conjunction with new advancements in AI-driven software engineering, the supply of easily accessible neuro-compatible apps will grow to unprecedented heights

In Perez's terms, this is what you build in late Installation if you want to dominate Deployment. As the curve steepens and the neurotech industry races from a few percent to mainstream adoption, the world will need a neutral, privacy-preserving, incentive-aligned platform that any device and app can plug into.

Elata intends to be precisely that: the connective tissue for the Cambrian moment of brain-aware applications that turns today’s market into tomorrow’s everyday infrastructure.

References

The Business Research Company. (2023). Neurotechnology global market report 2023: Market size, trends, and global forecast 2023–2032.

Introspective Market Research. (2024). Neurotechnology market: Growth and industry analysis, 2023–2032.

Global Market Insights. (2023). Neurotech devices market size, share and trends, 2023–2032. Global Market Insights, Inc.

BCC Research. (2023). Brain-computer interface: Global markets. BCC Research, LLC.

Grand View Research. (2023). Electroencephalography (EEG) devices market size, share & trends analysis report to 2030. Grand View Research Inc.

Introspective Market Research. (2024). Neurotech devices market report, 2023–2032. Introspective Market Research.

BCC Research. (2024). Medical devices: Technologies and global markets (Report No. HLC170F). BCC Publishing.

Grand View Research. (2025). Digital health market size, share & trends analysis report to 2030. Grand View Research Inc.

Fortune Business Insights. (2025). Digital health market size, share & COVID-19 impact analysis, 2025–2032. Fortune Business Insights.